A recent article in the New York Times “Can Amazon Be Wal-Mart On The Web?” by Brad Stone talked about how big and successful Amazon has become, even thriving in the downturn. Stone talks about the 605,000 square foot warehouse in Phoenix as just one of 25 such warehouses Amazon has, and talks about their pricing and how they don’t store similar things together for efficiency and accuracy reasons. Stone also talks about the fact that Amazon gets “negative working capital” which means they sell many of their goods before they have to pay for them, which he points out is unusual outside of the grocery store business.

A recent article in the New York Times “Can Amazon Be Wal-Mart On The Web?” by Brad Stone talked about how big and successful Amazon has become, even thriving in the downturn. Stone talks about the 605,000 square foot warehouse in Phoenix as just one of 25 such warehouses Amazon has, and talks about their pricing and how they don’t store similar things together for efficiency and accuracy reasons. Stone also talks about the fact that Amazon gets “negative working capital” which means they sell many of their goods before they have to pay for them, which he points out is unusual outside of the grocery store business.

While I don’t dispute any of the facts in Stone’s article, I think his analogy, and his article, miss the point of where Amazon is going.

I often compare Sam’s Club and Costco as two companies that are in the same basic industry (so “what” they are doing is nearly identical) with radically different operating models (Sam’s Club makes money selling its products, Costco does not – they make their money on their membership dues). The point is that comparing Sam’s Club and Costco is risky because they have such different success metrics in different parts of their businesses. Sam’s Club is a traditional retail operation in the retail industry, while Costco is really a membership business operating in the retail industry.

It’s an even worse analogy to compare Wal-Mart and Amazon. Yes, they are in fact both selling retail products, and probably a lot of the same products. Wal-Mart is absolutely a retailer, in many ways like Sam’s Club, but Amazon doesn’t view, or describe, themselves as a retailer any longer. They are a software company. Just ask them (or read the 11th chapter of the book Rethink).

Amazon is working (and succeeding) to be the backbone of all internet transactions. Their software enables merchants to leverage all of their pricing, shipping, and billing. Amazon as a giant retailer is the tip of the iceberg in terms of what they are really doing. If you start to compare Amazon with other software companies, the magnitude of their success is a much, much bigger story.

As an aside, Stone has some examples of companies that are suffering because of Amazon’s dominance, like Lombardi Sports in San Francisco. Again, I think that is a mis-characterization of what’s going on. It’s less that Amazon is hurting Lombardi, it’s that customers are going to the internet to buy more of their goods and in part because Lombardi has neglected its web site, that’s why they are suffering (that’s not the only reason). Internet transactions will continue to be a larger and larger percentage of all transactions, and merchants that don’t figure that out are the modern day dinosaurs.

One of the key points of the book Rethink is that you have to maintain alignment between what your customer wants and what they value, with your value proposition. Amazon isn’t the bad guy here, they are actually the good guy, enabling many of the little guy merchants make this shift to stay aligned with their customers.

-Ric

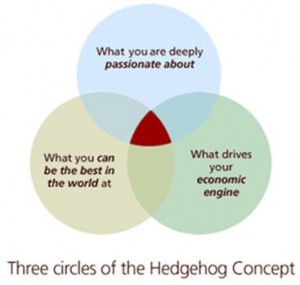

P.S. This is another great example of the issue I raised in a recent blog about the Hedgehog Concept in Good to Great by Jim Collins. While there are several parts to the Amazon business, it’s basically a software business and a retail business. At first the retail business was their Hedgehog (the intersection of what they can be best in the world at, what they are most passionate about, and what drives their economic engine), but now it’s their software business. So now that the retail business isn’t their Hedgehog, does that mean they cease to invest in it? Of course not, but you need to read Rethink for prescriptive guidance on how to tackle the tension of these two different businesses that can be competing for the same investment dollars.