This article in Saturday’s paper talked about the importance of making flexible donations to schools, adding a comment that if a donation 100 years ago was to pay for typewriters at a school, they still need to honor that specific purpose of the donation even though no one then could have anticipated how useless typewriters would be today (given the radical difference in “how” kids do their schoolwork).

Today we should be at least smart enough to know how much things can change. Which is why this other article that appeared Sunday seemed like such a great insight into how to get the right education to the next generation.

http://www.nytimes.com/2009/05/03/fashion/03sexed.html?_r=1&scp=1&sq=Birds%20and%20bees&st=cse

As people talk more about how differently different age groups communicate and take in information despite using the same tools from cell phone text messages, to e-mail, to Facebook, Twitter, and others, many people have come to the realization that the teenagers of today will be our office co-workers before we know it, and their ideas of normal and acceptable communication styles will probably be very different from what we know today.

We have already seen shifts in office behavior. Most of us used to use our office phones every day. Now, other than conference calls, an inbound call to my desk phone has become a novelty because e-mail is the primary means of communication where I work.

So backing that up to how these kids will learn, since many of them already have a totally different way of communicating and taking in information, that implies that “how” we teach them will also need to change pretty profoundly if we want the outcome of educated people prepared to enter the workforce (or whatever they want to do). It’s a good bet Amazon’s Kindle is a step in the future direction of textbooks (sorry backpack manufacturers).

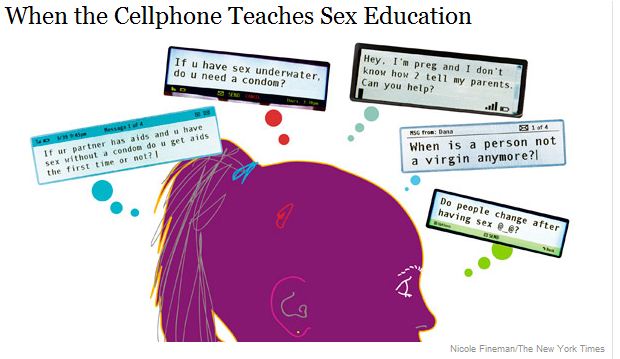

That’s why this article caught my attention. The piece “When the Cellphone Teaches Sex Education” about how the Adolescent Pregnancy Prevention Program of North Carolina set up the Birds and Bees Text Line to help kids answer questions about sex and sexuality. I expect not a lot about the content of sex education has changed since I was a kid, but my guess is a lot of kids still aren’t crazy talking about every detail with their folks, this is a great solution to educate kids on this topic since it’s in a familiar format and in this case it’s fairly private. Admittedly it’s a rapidly moving target, but educators need to start paying close attention to how kids take in information and start adapting their teaching methods accordingly. I realize timeliness can be a key part of sex education and that’s a big plus with text messaging, teaching European Civilization or Calculus may not have as much time sensitivity, I think we are starting to see a new world of education and how people learn. Rethinking education isn’t going to happen overnight, but there’s a lot of opportunity out there right now.

-Ric