It may come as a shock, but the industry that private equity firms and other large investment companies called Dental Service Organizations, are going crazy for right now – is dentistry.

In some respects the wave started around 2009 in the recession, private equity firms noticed that healthcare was one of the only industries growing when most other industries were suffering. When you look further into it – not only is dentistry the one healthcare professional we are supposed to visit at least twice a year, unlike physicians where only about 47% of them own their practices, 77% of dentists own their own practices. So there was a clear acquisition target.

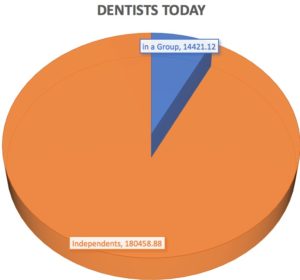

And it’s still early days. Right now only 7.4%, or 14,421 dentists are in a group in the US, that number is probably going to grow.

The other big factor is that new dentists coming out of school have big debts in the hundreds of thousands of dollars and many of them are inclined to join an existing practice than start their own – which would at least for the foreseeable future – add to their debt pile. With that happening at a time when the ratio of dentists per 100,000 people in the US projected to grow from 60.9 to 65.7 in the next 20 years, this trend is likely to only continue.

So why are the existing dentists whose practices often have over $1 million per year in revenue (what they call production) selling some or all of the ownership of their practices to private equity firms or DSOs or other groups that own multiple practices? In many cases it’s because they are not great at, or not all that interested in, running a business or choosing good technology or dealing with the increased need of their patients to explore new payment plans for treatments their insurance does not cover. They want to be dentists and have a good lifestyle.

So once you have those facts, it all make sense, and as a result a few things are likely to happen:

1-Being run more like businesses, and with a surplus of dentists, we should expect to see offices open nights and weekends. This is great for the new dentists (though they might not like the schedule – they will be able to pay down their debts), it will be great for the practice owners because revenue will spike, and it will be great for patients to have the added schedule flexibility.

2-Some of the practices owned by private equity firms or bigger companies may be told what to do to be more profitable, which is no surprise, but that might make things less fun for the dentists, at least for a while.

3-For the first time ever, it will be possible to roll up all of the data from all of these practices and see best (and worst) practices, apply artificial intelligence and predictive analytics to every aspect of operations in ways that will improve patient health and business efficiency. There’s a lot of talk about this over in medicine and cancer, but this is also going to happen very fast in dentistry. There’s a company called CareCru – they are already very far down the path of helping both independent practices as well as some of the biggest groups out their rapidly get to better efficiency and growth. CareCru has a product called Donna that’s powered by artificial intelligence, and while Donna automates a lot of things like reminders and appointments, and patient reviews and things you might expect – she also learns about each practice and within groups look across practices to learn and share information about best practices and things to watch out for – there’s really nothing like Donna out there and it’s exciting to watch.

So keep an eye on this space – some of the biggest advances come from places you least expect and right now dentistry is well positioned to take a giant leap forward with better patient health through big data analytics and artificial intelligence.