When I talk with people about favorite books, it’s very common to hear about Good to Great by Jim Collins. There’s no question there is some great thinking in that work.

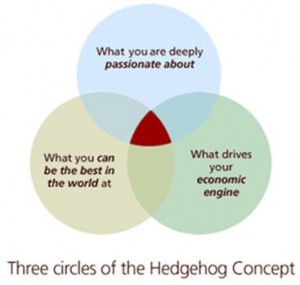

Specifically his Hedgehog Concept, where he instructs us to emphasize the work that sits at the intersection of “what you are deeply passionate about”, “what you can be best in the world at,” and “what drives your economic engine” – and that’s a great way to help organizations really identify what really matters most. Too often organizations have the attitude that “everything matters” which spreads efforts too thin and it’s no surprise they never rise to the level of greatness Collins talks about.

Specifically his Hedgehog Concept, where he instructs us to emphasize the work that sits at the intersection of “what you are deeply passionate about”, “what you can be best in the world at,” and “what drives your economic engine” – and that’s a great way to help organizations really identify what really matters most. Too often organizations have the attitude that “everything matters” which spreads efforts too thin and it’s no surprise they never rise to the level of greatness Collins talks about.

But in the hundreds of pages that make up this book, Collins neglects to provide guidance on what to do about the other six sections of this Venn diagram. What about things “you are deeply passionate about” that intersect with “what drives your economic engine”? Or things that just “drive your economic engine” and don’t touch the other two circles?

My basic point here is that a company is made up of many moving parts, and while it is enormously helpful to have a construct such as the Hedgehog Concept to help us get to what’s the #1 most important set of things, organizations still have to make investments, and especially now, investment tradeoffs, in some of the different parts.

I can name examples of companies that have had to face tradeoffs in each of the six other segments of this diagram, and if you are interested, I would be happy to provide you with that analysis. For now I will just give you an example of a company called Concur Technologies, and they were very clear about what their Hedgehog was. Concur Technologies makes software that helps organizations track and manage expense reports and they want people to access that software via the internet as a Cloud service. That’s what they wanted to be in that middle section of their Venn diagram. But there was a problem. The internet access version of their product was not driving their economic engine. The product that people bought and installed on their own computers (so-called licensed software) was what was driving their economic engine. They could be best in the world at that, but they were less passionate about it than the internet access version. So should they stop investing in their licensed software business? Of course not. But given finite resources, how should they make investment tradeoff decisions? They didn’t want to under invest in the licensed software business since that was driving their economic engine, but they also didn’t want to be too timid about investing in the cloud service that was their Hedgehog. I am not going to suggest that there is an “easy” button to answer this.

I can name examples of companies that have had to face tradeoffs in each of the six other segments of this diagram, and if you are interested, I would be happy to provide you with that analysis. For now I will just give you an example of a company called Concur Technologies, and they were very clear about what their Hedgehog was. Concur Technologies makes software that helps organizations track and manage expense reports and they want people to access that software via the internet as a Cloud service. That’s what they wanted to be in that middle section of their Venn diagram. But there was a problem. The internet access version of their product was not driving their economic engine. The product that people bought and installed on their own computers (so-called licensed software) was what was driving their economic engine. They could be best in the world at that, but they were less passionate about it than the internet access version. So should they stop investing in their licensed software business? Of course not. But given finite resources, how should they make investment tradeoff decisions? They didn’t want to under invest in the licensed software business since that was driving their economic engine, but they also didn’t want to be too timid about investing in the cloud service that was their Hedgehog. I am not going to suggest that there is an “easy” button to answer this.

What I will say is that with the heat mapping diagrams that are built through the ideas in the Rethink book, people are better able to be objective and very specific, at a more tactical level about what is most and least valuable to the organization, how those things are performing, and which specific changes will cause the overall organization to perform better. They serve as a compelling visual business case to support, or revisit investment decisions when difficult tradeoffs must be made.

Heat maps are an excellent complement to the Hedgehog.

-Ric

[…] this page was mentioned by Dennis Stevens (@dennisstevens), Steve Koss (@stevekoss), Mark Cummuta (@triumphcio), Dennis Stevens (@dennisstevens), Ric Merrifield (@ricmerrifield) and others. […]