I have talked a lot about the online retail bank ING DIRECT and how they made some really fundamental changes in their operating model to take advantage of the internet. Retail banking was a commodity service from the beginning, but location was where differentiation came in (a little bit like gas stations). So when the internet (and the ATM) made location irrelevant, ING DIRECT realized they could target (and ignore) very specific sets of customers, and succeeded. “What” they were doing remained they same as all other banks, but “”how” they did things like interest rates (very high for savings accounts) and withdrawals (no paper checks) were very different. I think a lot of other retail banks haven’t changed their operating models much, still, because they don’t realize one of the basic assumptions of their operating model (that location differentiates) is now largely flawed.

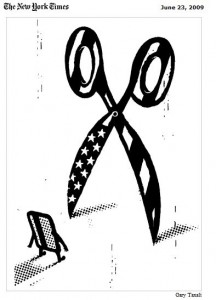

So when I read this article in the paper today about credit cards, I couldn’t help but think the credit card companies are also operating in a model where some of the most basic assumptions that used to be valid, aren’t any longer. The article starts out talking about the Credit Card Accountability , Responsibility, and Disclosure Act and then compares credit union credit card rates and fees with the rest. While I am no expert in the new act, I think the article actually missed the larger issue. Back in the 1970s and 1980s when credit cards were just getting going, a credit card was a luxury and a privilege (American Express rejected me at least once, and they didn’t even let people carry a balance), and to my recollection, we never even talked about interest rates. It was a handy utility that really saved you the trouble of carrying cash (and Karl Malden was still selling traveler’s checks with his “don’t leave home without them” pitch).

So when I read this article in the paper today about credit cards, I couldn’t help but think the credit card companies are also operating in a model where some of the most basic assumptions that used to be valid, aren’t any longer. The article starts out talking about the Credit Card Accountability , Responsibility, and Disclosure Act and then compares credit union credit card rates and fees with the rest. While I am no expert in the new act, I think the article actually missed the larger issue. Back in the 1970s and 1980s when credit cards were just getting going, a credit card was a luxury and a privilege (American Express rejected me at least once, and they didn’t even let people carry a balance), and to my recollection, we never even talked about interest rates. It was a handy utility that really saved you the trouble of carrying cash (and Karl Malden was still selling traveler’s checks with his “don’t leave home without them” pitch).

Today, invitations to add another credit card are literally junk mail. It is no longer a luxury, or a privilege to have a credit card, and I hear often that the average American is carrying over $6,000 in credit card debt. So what?

The issue is that the credit card companies, like the retail banks (other than ING DIRECT) still think about themselves. Credit card companies think about what their profit goals are, and they use the entire pool of customers to manage their risk. As the article points out, a lot of the fees and interest rate issues are because so many people don’t pay their bills. The obvious solution to me is that credit cards should be more like insurance companies in the sense that they can check out our credit score and based on that assess our risk, and then it would again be a privilege to get the “best” cards with the lowest interest rates, but people would have to earn that right and then those of us with good credit ratings wouldn’t have to pay for the debts of others who can’t or won’t pay their bills. That’s what’s in it for the customer, and I think that’s very fair, but what’s in it for the bank is a much more attractive risk profile, and on top of that, if they would rethink interest rates, and not treat them as a punitive tax, but in fact a luxury (for people with good credit ratings), they could offer closer to market rates on interest, and I might actually start carrying a balance if the interest rate was reasonable, and that would be an entirely new source of income for them (which, in volume, would be worth the trouble).

This seems like an obvious solution for credit card companies, and it also seems like a way to help shore up debt and debt risk on main street.

-Ric

My credit score last year got lower because i have some unpaid bills on my credit card company and i also lost my job.~’-