People are racing to blockchain for some really good reasons – it reduces risk, creates efficiency, and adds transparency for industries as diverse as logistics, banking, and healthcare. This article from The New York Times is a good explanation about it and what’s good about it. And this TED talk by Don Tapscott offers a very clear explanation of what blockchain is.

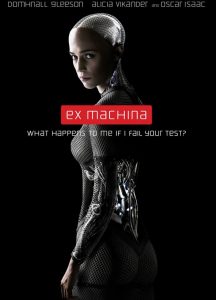

But there’s an issue I haven’t heard people talking about that seems like a “Houston we have a problem” kind of risk – or if you saw the movie Ex Machina – it feels a bit like the AI issue that movie hints at.

This TED talk gets into the patterns that will emerge from Big Data.

If you haven’t seen Ex Machina – it’s an amazing thriller of a movie that suggests that once artificial intelligence gets smarter than we are (in this case in human form) there won’t be anything we can do to stop it – and the implications are pretty scary.

Yes.

If you have an open source platform that can trace the full chain of custody of everything from radishes on a container ship, to heart valves in a hospital, to every transaction in a financial services company – you have transparency into everything. Part of the backbone of Wall Street and the global stock market is quarterly and annual forecasts and results.

If there is total transparency in all of these systems in real time and the systems are open sourced – even if companies try to make some or all of this data confidential or private – do you really think it won’t be hacked or exposed (if those two things are different)? That’s the promise of blockchain.

Hacking the personal data of tens or hundreds of thousands of accounts at Target was big news a few years ago. But hacking your grandmothers target account information is a bogeyman problem compared with gaining transparency to the global markets in real time.

Now one way to look at this is that if all of a sudden we can use machine learning to get predictive about that shipment of radishes to Whole Foods and what that means to their forecasts, and how many new accounts at Wells Fargo will do for their projections, or how many heart valves today will translate into Kaiser Permanente financial results – that real time global transparency will make the world smarter and we can do away with quarterly projections and that every thing will be run like Amazon (everything managed in real time).

But while that may seem like an interesting and viable end state – what seems like a more realistic outcome is that a small number of people will figure this out ahead of everyone (think The Big Short by Michael Lewis – but on a much bigger scale) and they will be able to game the entire global stock market.

That seems like a very big, very real risk and I don’t think we are ready for that.

So as we race to blockchain everything – let’s think through some of the downstream risks before we open up this new floodgate of Big Data.

Leave a Reply