It is “a time between times.”

That’s what Bruce Avolio at the University of Washington Foster School of Business said recently in a discussion about how broken the US healthcare system is. The system used to be great – and it will probably be great again at some point, but right now it’s broken because the old way is mixed up with a taste of the new way with technology, privacy, and big data in a way that makes 1+1 seem like less than zero. It’s going to be as awkward as a newborn giraffe for some time, I fear, but it will get better. The auto industry is in a similar spot – they ended up with some terrible products, but people still need that category of product, so companies like Ford got their act together and made a diving catch and, for now, have that company back on its feet.

But not every category is like cars and healthcare.

Big data and cloud computing are changing a lot of businesses, business categories, and customer behaviors, and in many respects that’s all the tip of the iceberg.

Big data is great and there will be loads of amazing things unlocked from all of that – as described in this TEDx talk, but we are not there yet.

Banking is in a category that’s another story. While people still need to keep their money somewhere and pay bills, and save and borrow, the old model of retail banking is already irrelevant. Companies like Paypal didn’t help – but more importantly, it’s companies like Amazon (and jet.com) that have really highlighted the shift in relevance.

Many of us buy lots of things from the likes of Amazon and Jet.com. It’s one stop shopping for everything from paper towels to birthday presents. Our credit card has become an extension of our bank account and once a month we move money from the bank to the credit card. Many of our other bills are monthly subscriptions that also go on our credit card – so the number of times we actually think about our bank account is much less than it was just five years ago.

Buggy whips became irrelevant when people shifted from horses to cars. Just like a lot of book stores went out of business when Amazon got big, and that’s part of the reason print newspapers are going away. Banks – and others- are fast becoming the next buggy whip maker.

Should they just give up?

Not at all.

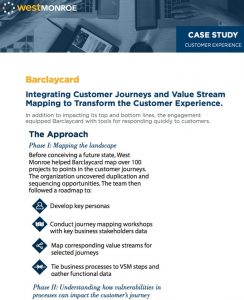

I was heartened when I saw a recent case study from West Monroe Partners about Barclaycard because I think it’s a step in the right direction.

Before the internet and big data came along, the big advertising inserts in the Sunday paper were enough because business was all still local. Today, less and less is local – it’s global. That means competition is global. That’s not news. But what companies have been slow to do to respond to that is really understand who their customers are, what they value, and what they don’t. The value stream mapping that West Monroe refers to is a great label for that. Break down the value stream, both on the customer experience level, as well as on the operational level, so you can “see” where your high and low cost areas are, in the context of value creation. That doesn’t mean you cut all of the low value things – it simply means that you invest in them differently (cut cost out of low value, non differentiators and figure out how to improve or protect the things that differentiate). Decisions like this need to be data driven, and while they don’t all need to be made in real time – they need to be pretty responsive.

The key is to see when demand models change and to test new ones – constantly.

Customers are comfortable switching brands very quickly – so do lots of A/B testing of different offers for different segments of customers within the value streams so you can be sure you are making the right decisions at the right time for the right customers with clear understanding of operational impact (if you push a lot of people online for new services – expect a lot of need for online help . . .).

Do have all of the right answers for all of the retail banks right now. I don’t. But if we know that lots of people use social networking that involves photos – think about extending the notion of a bank to be a photo bank – because you might always be happy with Facebook – but you ought to always trust your bank and banks are really good at helping you change banks if you ever decide to do that – because they are required to by law – Facebook doesn’t have to do that. Similarly – if you know that your banking customers are in office buildings that have retail shopping space and food courts – think about how to engage them in that setting so you can be relevant there as well.

Testing demand models requires a handful of key deliverables/data and here’s a list:

-Do the value stream mapping – see where value is, and is not created

-Map customers, by segment, to the value stream to see where different customers value different things

-Break down the full customer experience journey from discovery through enrollment, and so forth (see other blogs about that)

-Map the operational cost/effort that goes along with the customer experience to see where you are over/under spending on operations relative to value creation

-Create heat maps of the capabilities that are over/under performing by customer segment

-Establish future state target maps to help all members of the team be clear about the path you are on

The org charts, process work flows and scorecards of old are probably looking in the rearview mirror and not forward looking enough. Even if some of the terms above sound like new labels for things you are already doing – give this a try.

So in this time between times – keep your finger on the pulse of customer demand – and that usually means getting a new set of tools and measures to have the confidence you are doing that correctly.

I don’t intend to pick on retail banking – it’s just such a familiar industry that touches all of us – and it’s really in trouble right now.

Leave a Reply