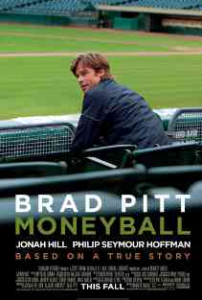

If you somehow missed it, they turned Michael Lewis’ book Moneyball into a movie that premiered last weekend. Given how much coverage it got, I was stunned to see it come in third place at the box office, behind the re-released Lion King of all things.

If you somehow missed it, they turned Michael Lewis’ book Moneyball into a movie that premiered last weekend. Given how much coverage it got, I was stunned to see it come in third place at the box office, behind the re-released Lion King of all things.

I have been aware of the book and Billy Beane since Beane turned the baseball world on its ear by proving that the old school measure of talent, batting average, was necessary but not sufficient to make the best decisions about hiring, and talent is everything in baseball – or to put it in Yogi Berra-oid terms – 90% of baseball is 50% talent.

Beane showed that things lke on base percentage, slugging percentage, even the number of walks a player gets can have greater statistical impact on the outcome of games – and of course winning is what matters in the end. And for years, Beane was the only one managing a team this way, so he had the advantage and his team did better while spending less on their talent (because everyone was still so focused on batting averages). Now everyone follows this model so the playing field is once again relatively level (albeit a new higher level).

Friday I was listening to NPR and they were talking about the book and the movie and why the book was such a huge hit and the person they were interviewing said it really well – he said the reason Moneyball was such an “important” book was because it rattled an entire industry by showing it the set-in-stone metrics that industry was using were not enough, and that sent ripples into other industies suggesting that they rethink their metrics as well. In many respects, my book Rethink is a guide to helping organizations do just that.

After I heard that piece on NPR I saw two different articles in The New York Times talking about two very different companies who have followed the Moneyball/Rethink logic and offer some great examples of non-obvious changes.

The first one, about Marvin Windows and Doors offers a couple of great nuggets. This company has a no layoffs policy which is really rough in this economy. But this is no Kumbya article. Because Marvin kept employees while other competitors laid people off and shut plants, when there were bursts in demand – Marvin was not only able to address this when others could not – the result was an actual gain in market share. The message is that short sighted layoffs cost their competitors market share as the recession hit them. The article wisely points out that if Marvin were public, this would never have happened – but that’s yet another argument against a company being public – it so often drives such short-sighted decisions, that things like this are not possible. Great story.

The other article is about a company called cater2.me and tells a good story about adding middlemen in an economy where disintermediation is the juggernaut du jour. Cater2.me does something really simple, but the rethinking going on is more subtle than Marvin Windows, or the Oakland A’s. Cater2.me delivers food to offices. Really simple idea, not new, but their pitch is where the rethinking comes in. When you have highly paid salaried employees, it’s “expensive” to have them walk out the door and go to lunch every day. If you bring good food in and have them eat in the office, that 20% or 30% or 60% increase in productivity you get from those employees makes for a very simple business case for the company to cover the cost of lunch. Don’t think of the cost by itself, think of the cost in terms of the overall outcome you seek – winning at whatever it is you do.

There you have it.

Play ball.

-Ric

Leave a Reply